Advancing Reserve Transparency in Tokenized Gold

Tokenization of Real-World Assets (RWAs) is one of the fastest-growing segments in on-chain finance, with the potential to bring more than $400 trillion in traditional assets onto blockchain infrastructure. As the industry matures, trust and transparency in the underlying asset become critical to sustainable adoption. Commodities, particularly gold, given its long-standing role as a store of wealth, offer a clear case study of how tokenization can modernize legacy asset classes by delivering verifiable, real-time proof of backing, enabling investors to confirm holdings with greater clarity than is typically available in traditional markets.

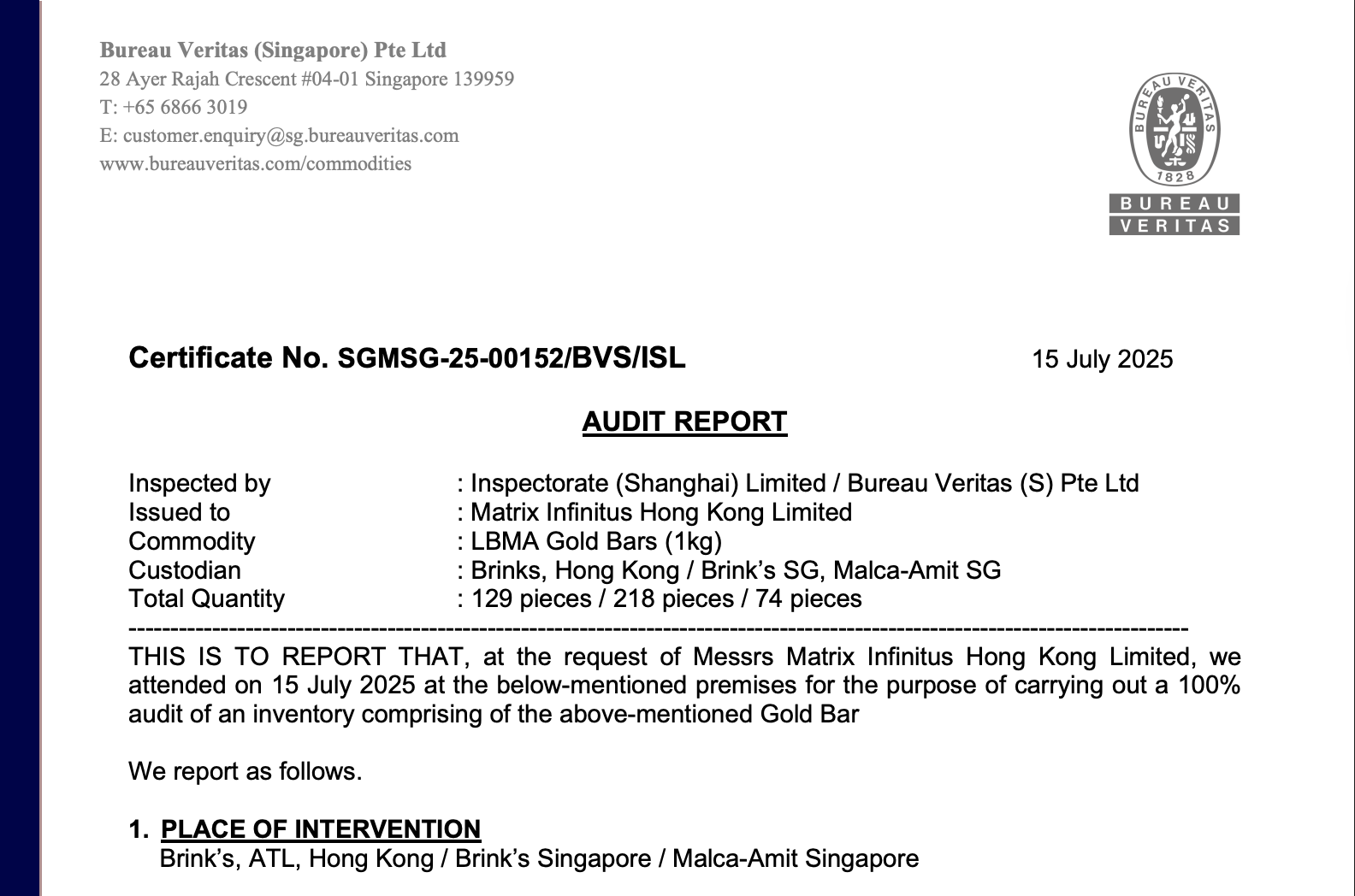

Matrixdock, a Singapore-based RWA tokenization platform under the Matrixport Group, is a member of both the Tokenized Asset Coalition (TAC) and the Singapore Bullion Market Association (SBMA). In July 2025, it completed its second independent audit of XAUm’s physical gold reserves, demonstrating how regular third-party verification can enhance confidence in tokenized gold.

This latest audit, conducted with institutional-level rigor and combined modern technology, reaffirms that each XAUm token is backed 1:1 by 99.99% purity London Bullion Market Association (LBMA)-accredited gold. It illustrates how tokenization technology can bridge the gap between the physical and blockchain worlds, making each token’s backing both verifiable and traceable in real time.

Why Reserve Integrity Matters in Tokenized Assets

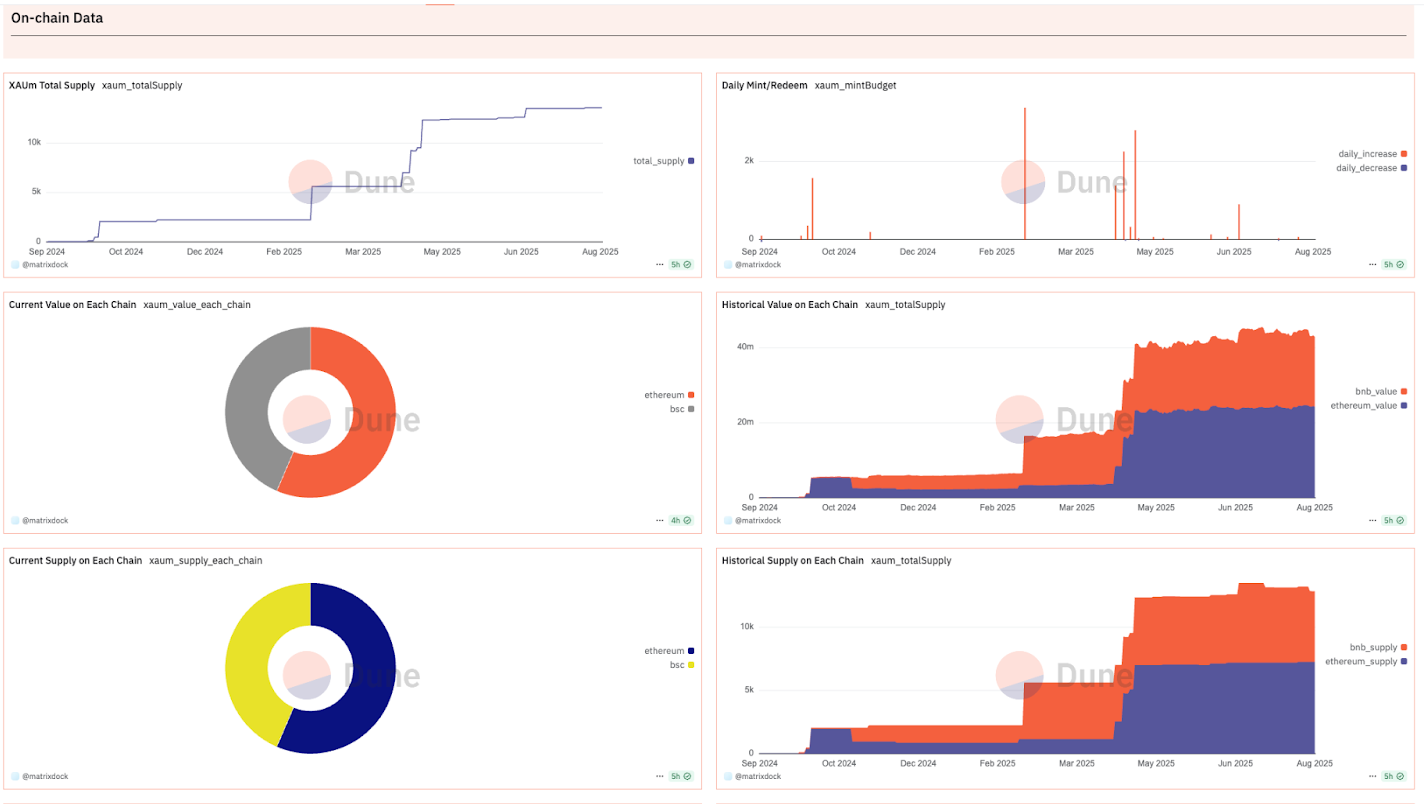

XAUm integrates dual complementary verification layers: professional third-party inspections, conducted by the same auditor that serves leading gold ETFs such as SPDR Gold Shares (GLD), and a continuous, real-time blockchain-based third-party data provider such as Dune Analytics. Together, these processes provide investors with unprecedented visibility into the gold holdings backing each token.

Inside a 2025 Semi-Annual Audit of Tokenized Gold

The audit was conducted on July 15th, 2025, and inspected 421 pieces of LBMA-accredited 1-kilogram gold bars stored across three secure vaults: Brink’s Hong Kong, Brink’s Singapore, and Malca-Amit Singapore.

Each bar was individually weighed and measured to verify the accuracy of its physical specifications and to confirm its consistency with recorded vault data.

The results:

- 421 kilograms of gold = 421 pieces x 1kg (equivalent to 13,534.308 troy ounces)

- Matching total circulating supply of 13,534.308 XAUm tokens

- Approx. USD 45 million market value (with gold trading at $3,335 per troy ounce)

Why are there re-seal numbers in the report?

When gold bars are delivered from the refiner to the vault in storage boxes, the vault verifies each bar against the records and secures the boxes with a nylon rope seal marked with a serial number. During an audit, the seal is cut open for inspection. Afterward, the boxes are re-tied with a new seal carrying a different serial number. These re-seal numbers confirm the boxes were opened for audit and then securely closed again.

Bridging Physical Audits and On-Chain Verification

Matrixdock’s Gold Allocation Lookup tool allows token holders to see exactly which gold bars back their XAUm holdings, with updated vault information available in real time.

This illustration demonstrates how an investor can verify the exact gold reserves backing their XAUm holdings directly from their digital wallet. The interface provides full transparency down to the bullion ID, refiner, vaulting location, and the investor’s proportional ownership of each bar.

Each XAUm token is backed by 1 troy ounce of 99.99% gold. Since a standard 1kg gold bar equals 32.148 troy ounces, a full allocation of 32.148 XAUm corresponds to one whole bar. For example:

- Line 1 shows 32.148 tokens fully allocated to Bar ID HS17862 with 99.99% purity, refined by Heraeus and stored in Brink’s vault.

- Line 3 shows 8.772 tokens, representing 27% ownership of Bar ID HS17868 with 99.99% purity, also refined by Heraeus and stored in Brink’s vault.

This creates a traceable link between a physical asset and a digital token, something that’s historically been opaque in precious metals markets.

Raising Transparency Standards for the RWA Industry

This industry-leading transparency practice, combined with semi-annual professional third-party audits, real-time allocation look-up, and on-chain analytics, illustrates how tokenized assets can achieve a higher standard of transparency.

This approach strengthens confidence for both individual and institutional holders and provides a practical blueprint for how RWA issuers can align with emerging industry best practices.

Gold’s Modern Role Through Tokenization

In an environment of global macroeconomic uncertainty, gold remains a trusted tool for wealth preservation and hedging. Tokenized formats make gold exposure more accessible and more functional, enabling fractional ownership, physical or stablecoin settlement, and DeFi integration, without sacrificing the transparency and security that gold investors expect.

The case of tokenized gold shows how RWAs can modernize long-standing asset classes, making them more transparent, divisible, and interoperable. This model highlights a pathway for broader adoption of tokenization across global markets.

Learn more about XAUm: https://x.com/matrixdock