Doubling Global RWA Users Amidst Unimaginable Tragedy

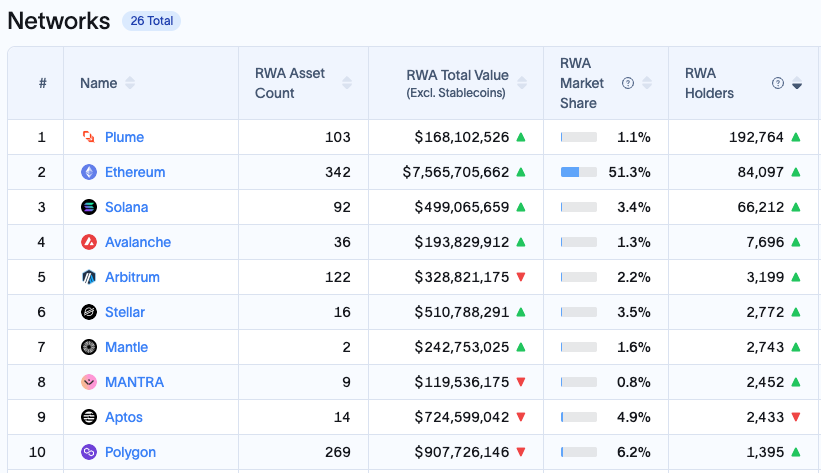

Six weeks after their launch, Plume had flipped Ethereum as the #1 chain for RWA holders and doubled the entire tokenization user base from 150,000 to over 320,000 users. Today, more than half of all RWA holders globally now use Plume. But behind these staggering numbers lies one of the most challenging founder stories in crypto.

The Crypto-First Bet That Worked

While traditional RWA platforms courted institutions first, CEO Chris Yin and the Plume team made a seemingly contrarian bet: solve the demand side first. "99% of stuff when you tokenize and put onchain actually gets much worse. It's more expensive. It's harder to use. You've got smart contract risk, counterparty risk. Most things get worse."

Their solution wasn't another tokenization engine, it was building an entire ecosystem where tokenized assets would be genuinely useful. They started with the Goon community, memes, and guerrilla marketing to crypto natives who actually understood composability and DeFi. The approach worked: their cartoon mascot and "goon" culture became the unlikely face of institutional-grade tokenization.

Leadership Through Loss

Just as Plume was hitting its stride, tragedy struck. Co-founder Eugene passed away unexpectedly, leaving the team devastated during their most critical growth phase. Chris was incredible to be so open about this during the interview and he became emotional as he was recalling the moment: "Everyone said the same thing... this is part of Eugene's goal and part of Eugene's vision... let's really make sure that this lasts and means something." The pauses and repetition reveal how difficult it still is to process this immense loss. "I remember thinking that's pretty extreme, you know, I know we like to work hard here, but like, we don't have to... And everyone said the same thing, which is like, look, we we're grinding so hard for this, and this is part of Eugene's goal and part of Eugene's vision... let's really make sure that this lasts and means something."

In other words: rather than collapse, the team rallied harder. Yin's leadership through this crisis, which included giving the team space for grief while maintaining momentum, became a masterclass in founder resilience. The team returned stronger, channeling their grief into building something lasting. Not just for themselves. Not just to make the financial pipes work better. But also to preserve Eugene’s legacy.

Getting Institutions to Chase You

Plume's institutional strategy was pure venture capital thinking applied to partnerships. Instead of pitching traditional financial firms, they built something worth chasing. "There are two kinds of people: people that chase and people that get chased. We have to make Plume something that people chase versus us chasing. Because if we're chasing, we're going to put in all the effort and energy in the world and the fundamentals could be the exact same, but we will never get the light of day."

They spent months learning institutional needs without selling, building genuine relationships, and understanding compliance requirements. When major asset managers like Apollo and Brevan Howard finally came to them, Plume had "ball control" in the negotiations.

Beyond Cost Savings to Asset Creation

The long-term vision extends far beyond digitizing existing assets for operational efficiency gains. Yin sees a future where the line between onchain and offchain disappears entirely: "This isn't about giving back 50 basis points in costs, it's about creating entirely new asset classes and investment strategies that couldn't exist in traditional finance.”

The tokenization space is watching Plume's meteoric rise closely. Not just for the technical innovation or impressive user metrics, but for proof that crypto-native approaches can scale to institutional adoption while maintaining the composability and innovation that makes blockchain transformative.

Bottom Line: Plume's success stems from solving demand before supply, building genuine community before seeking institutional partnerships, and maintaining unwavering focus on growing the entire crypto ecosystem rather than just their own platform. In six weeks, they've shown the tokenization industry what's possible when you start with users who actually understand the technology.